Looking to calculate the amount of taxes you need to pay in 2019 for the previous year?

Here we have brought for you a detailed guide with the tax brackets to help you in the process.

The first step is to establish which tax filing status you fall into. Below are the 5 to choose from:

- Single: Unmarried or legally separated taxpayers may use this status.

- Head of Household: Single or legally separated people can claim this status if they have a qualifying child or children for which they pay at least half of the support.

- Married, Joint Tax Filing: If you are married and filing tax preparation with your partner.

- Married, Separate Tax Filing: You can file tax return separately even when you are married, which normally results in higher liabilities.

- Qualifying Widow(er): Similar to joint tax filing, but the person needs to have a qualifying dependent and the spouse must have passed away in 2017 or 2018.

Note: All the statuses are applicable as of December 31st, 2018.

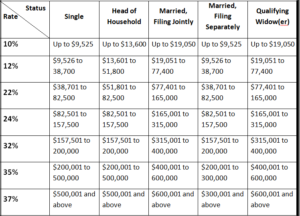

Rates Of Tax Filing:

As of 2019, all the 7 tax rates have changed. The new tax rates are as follows: 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

Below is the newest tax brackets according to your status and tax rates that would offer much better assistance:

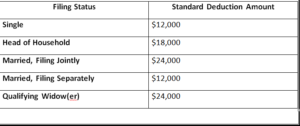

Standard Deductions:

The standard deductions for each of the statuses are as follows:

Major Tax Changes For 2018:

In addition to the income tax rates and brackets, other notable changes have taken place. Please note:

- Both the forms 1040A and 1040EZ have been eliminated. You now have only Form 1040 to file your taxes on.

- You can deduct up to 20% of the qualified business income from business with certain limitations.

- The child tax credit has been increased to $2000 in 2018 (against $1,000 in 2017).

Do You Need Tax Preparation Assistance?

Many individuals, businesses, and firms find it hard to understand the special terms and changes in the existing trends.

If you are facing any such troubles, you can get assistance from reputable tax preparation services which keeps track of all the updates and offers you the best support in preparing your taxes.

It is always a good idea to consult with experts to avoid any hassles or troubles!